Shares of fast casual chain Chipotle Mexican Grill (CMG) are holding above $400 per share recently as investors cling to hopes that a full recovery is taking shape after e coli outbreaks halted the company's impressive growth trajectory. Unfortunately for CMG bulls, the numbers do not seem to support that thesis.

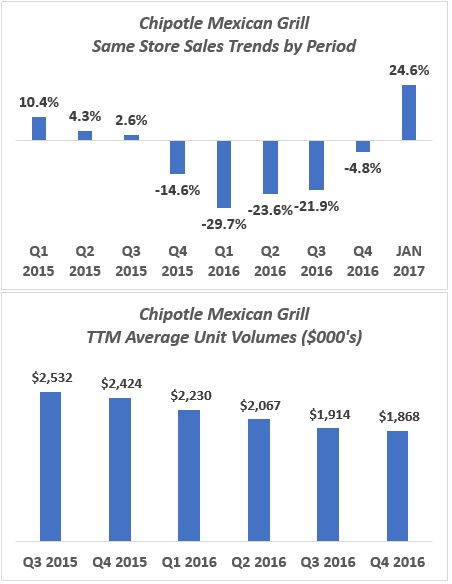

Same-store sales have gotten back into positive territory in 2017, as the initial health issues from late 2015 are being lapped on the calendar, but overall sales volumes have not seen any improvement. Below are charts showing same-store sales (promising) and average unit volumes (illuminating) for CMG:

Even though same-store sales improved in Q4 2016 vs Q4 2015, total sales volumes continue to decline both year-over-year and sequentially. The year-over-year drops will likely continue for at least the first half of 2017, whereas the sequential declines will likely end very soon. The problem is that CMG is still planning to grow total units at a healthy clip (nearly 10% annually) and new units are only bringing in roughly $1.5 million each in annual revenue (~75% of mature units). This is most likely due to cannibalization from existing units, which limits volumes from new locations (proximity between units shrinks as more are opened).

Chipotle's stock was a huge winner before the e coli issues due to lower build-out costs, high unit volumes, and profit margins that were the envy of peers. As the company continues to grow, the numbers will work against them and make it very difficult to regain their former financial glory ($2.5 million in average unit sales and four-wall margins of 27% at their peak). Without those kinds of metrics, the stock price looks richly priced at current levels with an equity market value well north of two times annual revenue. Buyer beware.

Full Disclosure: No position in CMG at the time of writing, but positions may change at any time