This week we learned that the components of Dow Jones Industrial Average (DJIA) will be changing again later this month. As former blue chip companies become less relevant over time, those who oversee the index seek to modernize it by replacing former darlings with new age companies that are more dominant in the current economy. Not surprisingly, such actions offer an interesting lesson on contrarian investing. To get booted from the Dow 30 a company must really be struggling. Conversely, if you are chosen as a replacement, chances are good that things have been going well lately.

Back in 2005 I talked about this and showed that the stocks that are removed from the Dow have actually outperformed their replacements after the changes were made. So yes, making these changes to the index has actually hurt its long-term performance, even though the motivation is exactly the opposite. While my piece is nearly a decade old, it remains relevant as the trend has not abated in any way. Here is the link: Examining Changes to the Dow 30 Components.

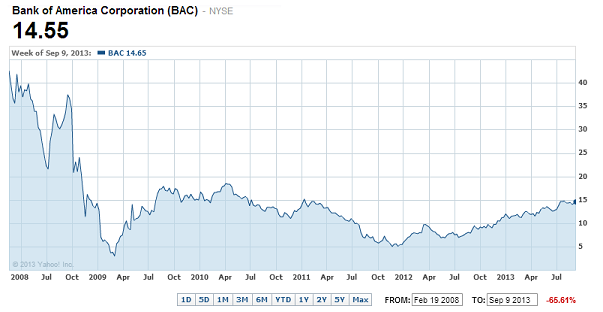

Looking back over the last 15 years shows that the Dow 30 index has been an especially bad timer of financial stocks. Bank of America (BAC) is one of three stocks that is being removed from the index this time around (Alcoa and Hewlett Packard are the others). Amazingly, BAC has only been part of the Dow 30 for five years. Since it was added in February 2008, the stock has collapsed from $42.70 all the way down to its current quote of around $14.50 per share. That 66% decline is quite astounding, as the chart below shows.

Now you might think that Bank of America is an isolated case, because it was added to the index at the peak of the last banking cycle, right before the financial crisis began (great timing Dow Jones!). In fact, mistiming financial stocks is a trick the index keepers have been perfecting for a long time!

Prior to Bank of America, the last large banking-related stock added to the Dow 30 index was.... drumroll please..... AIG! American International Group (AIG) was added to the Dow in April 2004 when it was trading at $76.25 per share. If you thought BAC made a quick exit after five and a half years, AIG lasted only four and a half years. It was removed from the index in September 2008 at the plump price of $3.85 per share, for a loss of about 95%.

I won't belabor the point much longer, other than to mention that before AIG, Citigroup (C) was added to the Dow in 1997 and was then removed in June 2009 at $3.46 per share (you can guess how brilliant of a move that was).

Not only has the timing of financial stock removals from the Dow 30 been so lousy, but they also epitomize the contrarian investment strategy inherent in these psychologically-motivated index changes. AIG and Citigroup shares have been roaring higher over the last two years. If you had to buy just one of the three stocks being removed from the Dow this time around, Bank of America looks like the obvious choice.

Full Disclosure: Clients of Peridot Capital Management were long shares of BAC and AIG at the time of writing, but positions may change at any time.